The sooner you can get out of debt, pay off your credit cards and consistently pay your bills on time, the sooner you will raise your credit score. Heavy debt loads and not paying your bills on time also negatively affect your credit score.

A low credit score will result in higher interest rates on your credit cards and higher insurance payments. FICO ® scores are used by 90% of top lenders to make billions of credit-related decisions every year.Įach FICO® score is based on information that three credit bureaus, Equifax, TransUnion and Experian, keep on file about you. The best expense tracker apps are designed to help you get out of debt and improve your credit score. Reduce Your Debt and Raise Your Credit Score This makes it easier to stay aware of your goals and stick to your budget.

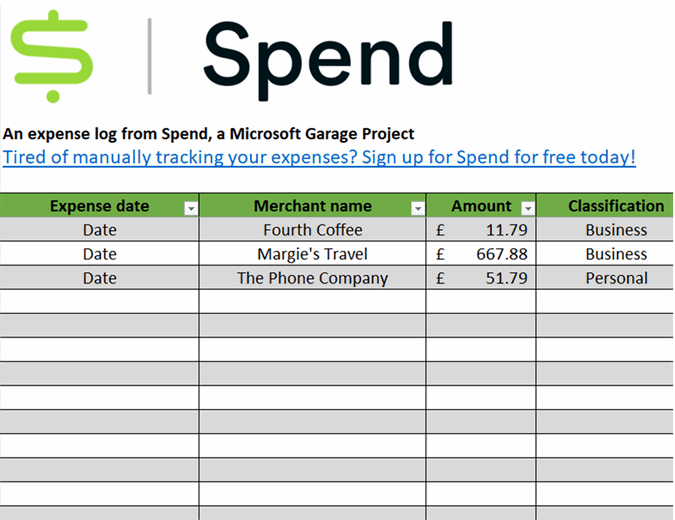

Once you’ve set up a budget (you can do this easily with a budget app) an expense tracking app will help you monitor your spending with alerts to remind you of upcoming bill payments or to let you know when you’ve exceeded your limit in a spending category. Help You Create and Stick to a BudgetĪrmed with a new understanding of where your money is going and what kind of spending issues hold you back, you can create a budget and make choices about where and how you want to spend your money going forward. Once you see the whole picture, you can start making adjustments that will lead to a more secure financial future. It also lets you know what you’re spending it on and why you’re making certain choices, especially ones that put your finances in the red. It lets you know how much money comes in and goes out, where and when you spend your money. One of the most important things an expense tracker does is give you insight into your spending habits.

0 kommentar(er)

0 kommentar(er)